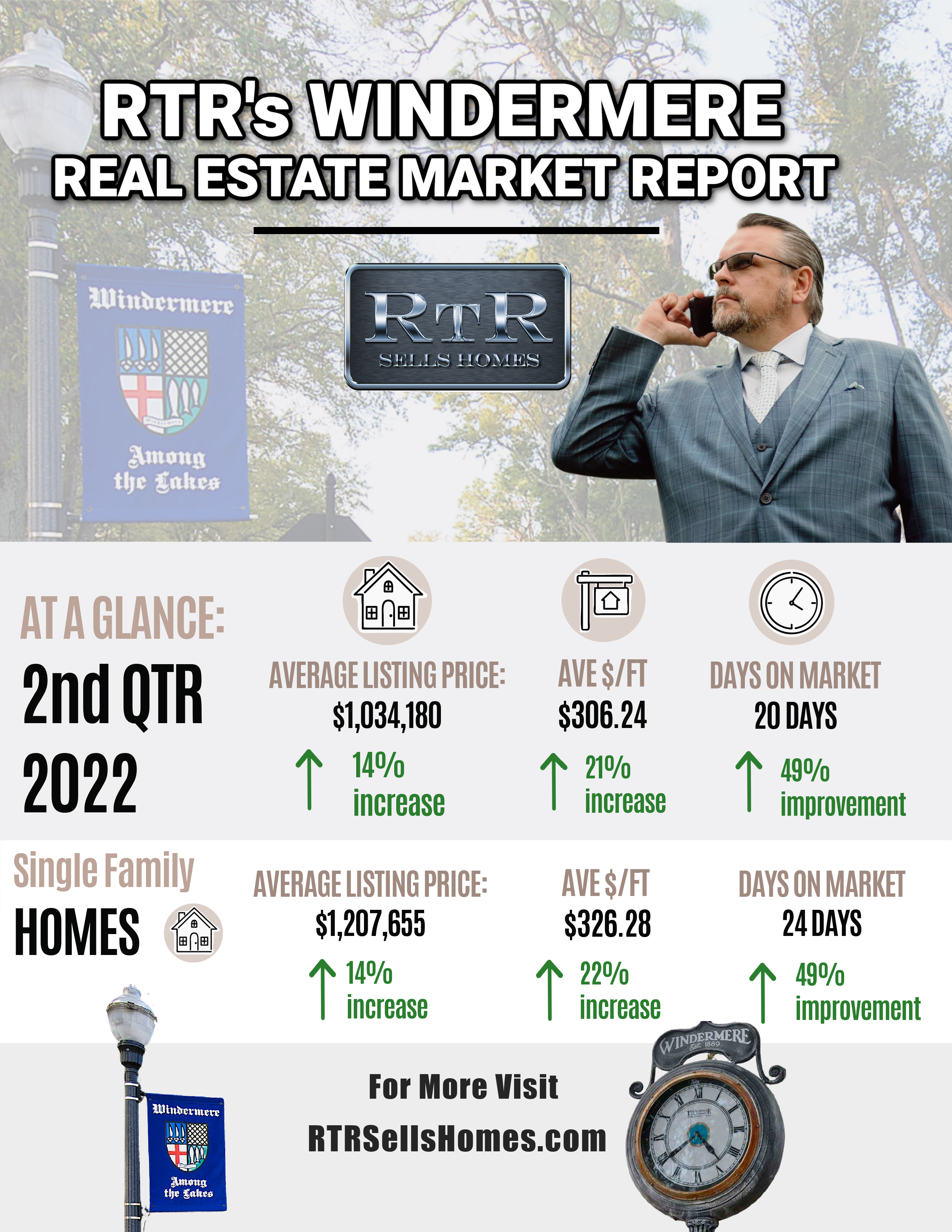

2nd Quarter of 2022

Welcome to the only place on the web that breaks down Windermere Florida 34786 real estate market to this level each and every quarter for well over the past 2 decades. All the data here is derived from the ORRA MLS and deemed reliable. It has been analyzed by longtime Windermere resident Ron the Realtor. Ron is the #1 Remax Realtor in the entire State of Florida for FIVE CONSECUTIVE YEARS and is currently number 5 in closed volume HISTORY for Orange County in the entire ORRA MLS.

Thank you for taking a few minutes to read the Ron the Realtor Windermere 2 nd quarter Market Year in Review. RTR provides a quarterly report and a full-blown end of the year in review report to anyone that wants to read it. No subscription, no registration of our email… anyone can read it, even competing Realtors…who does that? Ron has always believed, knowledge is power.

HIGHLIGHTS

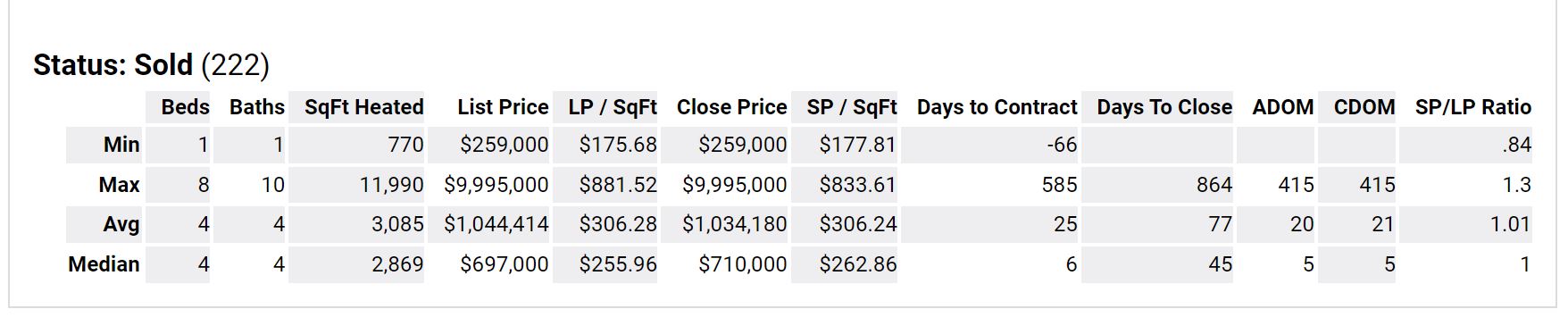

1,034,180

20

306.24

Windermere 2022 2nd quarter

Windermere 2021 2nd quarter

WINDERMERE 2022 Single-Family

1,207,655

24

326.28

Windermere 2022 2nd quarter Single Family

Windermere 2021 2nd quarter Single Family